In 2025, textile printing is undergoing a turn to regional production. Buyers demand local chains, fast delivery, and stable quality. About 60 percent of U.S. consumers are willing to pay more for goods made in the country. This sets the course for DTF printing and Direct to Garment, where short series, customization, and timing control are becoming the norm.

Localization And Demand

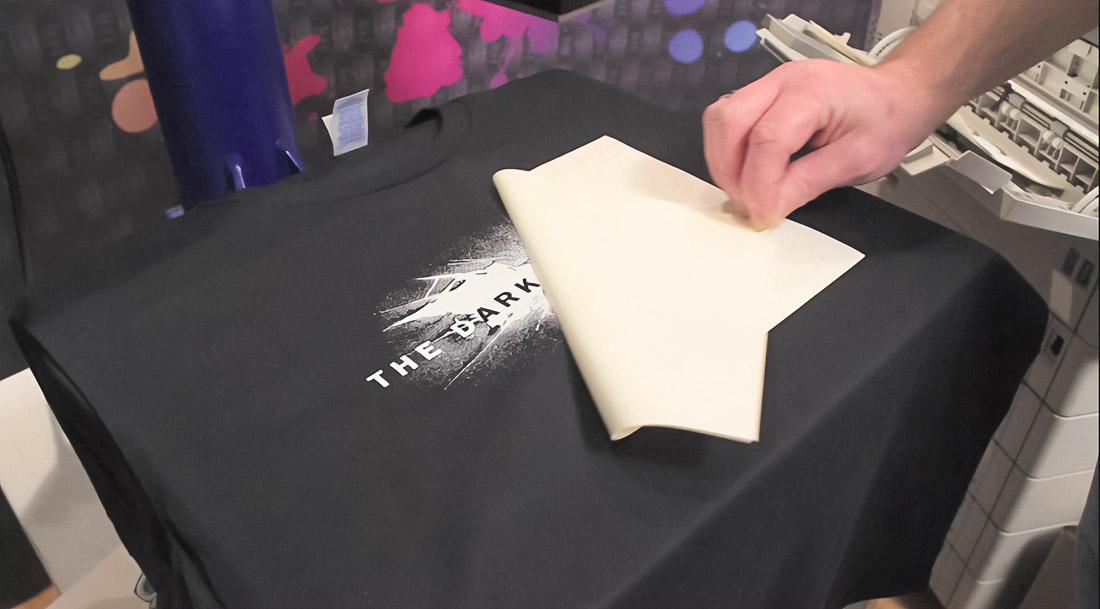

Local manufacturing solves several tasks at once. Predictable logistics reduces disruptions and delays. The quality is monitored on site without long shipments. Customers receive ready orders in 24–48 hours, while overseas shipments often take 1–2 weeks. For small print runs, screen printing loses its effectiveness. DTF printing works without manufacturing screens and quickly switches between orders. The figures confirm the dynamics. The Direct to Garment market is estimated at $1.39 billion in 2025 and could grow to $1.96 billion by 2030 at a 7.2 percent CAGR. North America remains strong. This supports nearshoring and microfactory development.

Economics Of Short Series

When ordering T-shirts, the comparison clearly shows the logic of the decisions. An import form, a foreign transfer and a local application give about $8 in cost at a price of $16. The Made in USA model raises the cost to $12 due to more expensive forms and local transfers. The retail price of $20 keeps an $8 margin. The interest margin is lower, but the dollar benefit is growing. For a business, not only the share is important, but also the absolute income. Commercial heat presses manufactured in the USA last for years. Practice shows a period of more than seven years without failures. The price difference between $2,400 and $800 with such a resource is about $228 per year. Reliability and downtime are more expensive than they seem at the start.

Technology, Materials And Sustainability

DTF printing relies on pigment ink, PET film and powder glue. Today, some of the components come from Asia. However, key operations can easily be transferred to local sites. These are application, quality control, packaging, shipment. In DTG, the demand structure is also shifting. Cotton retains about 49.8 percent, while polyester shows a 7.4 percent CAGR. Pigment inks occupy 61 percent, while dispersed formulations add about 8.2 percent. Technical textiles are growing fastest with a CAGR of 8.6 percent. The ecological vector is increasing. Volatile compound emission requirements are driving the transition to water-based inks and reducing waste. DTF minimizes chemical maintenance by not using screens. Local printing reduces shipping and associated emissions.

The picture is complemented by the introduction of sensors, predictive maintenance and process automation. Production is easier to scale without sudden recruitment. The loads are redistributed between narrow sections. Orders with mixed complexity are processed without long stops.

Hybrid models are coming to the fore. DTF closes orders from one to five hundred units. Complex illustrations, multi-color designs, and personalization. Screen printing takes large print runs and simple graphics. Such an alliance increases the payback of the fleet, reduces downtime and improves deadlines.

The choice is obvious for those who work with online, seasonal collections, and frequent art updates. Local DTF transfers, high-quality forms, process discipline and transparent customer value. Fast delivery, stable colors, predictable fit. When clear cost, margin, and timing indicators are added to this, regional production transforms from a slogan into a sustainable operating system.

The result is simple. The demand for local solutions is growing. Short series require flexibility. DTF and Direct to Garment give businesses a tool that combines speed, quality, and control. The facts confirm the trend. The market is growing, materials are diversifying, and sustainability is becoming an argument. Those who build workflow around local execution gain a competitive advantage today.

Cyclist, vegan, music blogger, hand letterer and ADC member. Producing at the nexus of design and elegance to craft experiences both online and in real life. German award-winning designer raised in Austria & currently living in New York City.